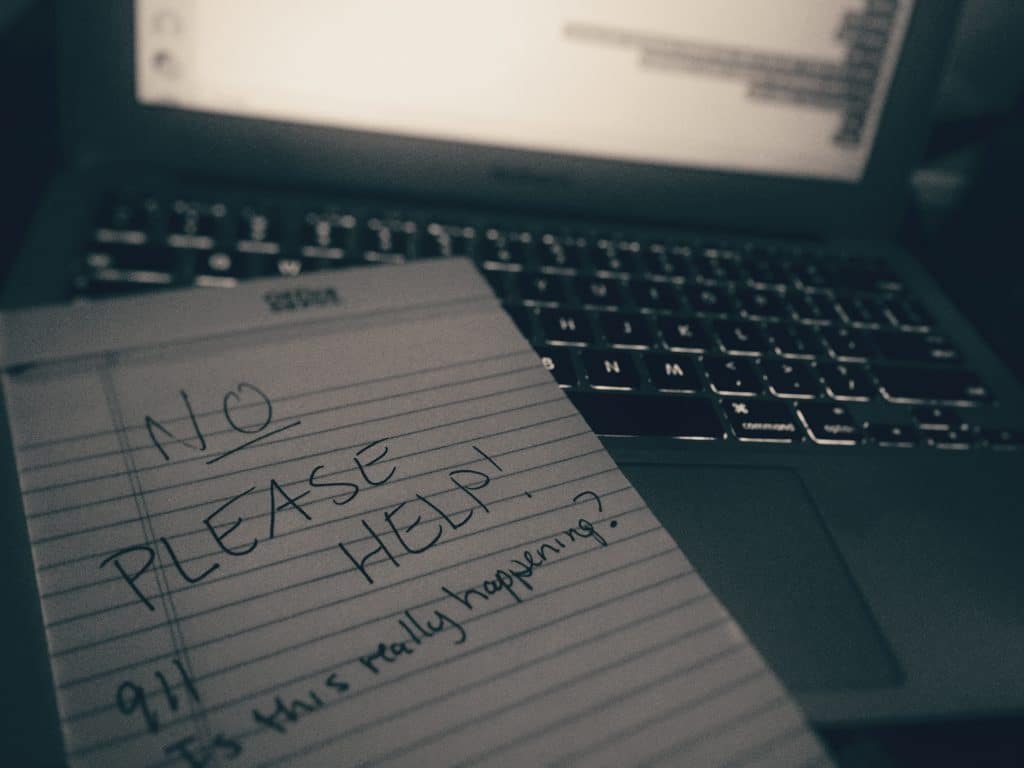

Virtual kidnapping scams are on the rise and, since it is difficult to identify the perpetrator, they are unlikely to go away. Last week a Facebook friend posted about a terrifying telephone scam. She encouraged me to share her story. Be warned, it’s really upsetting, and it’s a true story! It’s worth the read so you won’t fall emotional and financial victim to scammers, phishers, and extortionists.

“Mommy! Mommy! Mommy! He’s got me! He’s got me!”

A mother’s WORST NIGHTMARE, and it happened to me Saturday morning.

I was at home working in my office when my cell phone rang. I picked it up and heard a girl screaming and crying, “Mommy! Mommy! Mommy! He’s got me! He’s got me!” Then a male voice saying, “Shut the f__ up b___!” The girl’s voice sounded like my daughter who is living away for graduate school.

The world beneath me fell away. I can’t tell you the fear I felt. This VILE man spoke to me in a thick accent telling me what he is going to do to her, and after he’s finished with her he will send her home to me in pieces if I don’t give him money right now.

For the next twenty minutes, I spoke to the “kidnapper” while the police coached my questions and traced the call. I demanded he put her on the phone and text me her picture. He continued to threaten terrible things. Meanwhile, our calls to my daughter went to voicemail, so they sent Arizona police her work.

My husband and other daughter could see my texts, CALL HOME NOW!!!! URGENT!!! and were freaking out. Neighbors told them the police were everywhere, and they couldn’t get through.

Finally she texted after the police located her at work. They checked her apartment and verified it was safe. I broke down crying.

I don’t want ANYONE, EVER to go through what we did! The fear and possible reality were there for me for what seemed like hours! All I have thought about ALL weekend is “These VILE people are putting someone else through this!” Please share this story about the new horrible scam out there.

Source of the Theft

A few days after my friend posted this story, I followed up with her. She informed me that another family from the same university was scammed by the same man minutes after he hung up on her. They were about to wire $7000 before they were able to contact their daughter. This incident made her wonder if the information was gathered from hacked university data. A few weeks later, another Facebook friend posted this one:

My dad asked a few questions and was thinking it may be a scam, but he said the person on the phone sounded young, so he wasn’t quite sure. After a few questions, the kid hung up. We’re pretty sure that he would have asked for money to wire or something. My son is safe at school (I checked). But wanted to pass this on to you guys. Maybe this scam has been going around? Obviously, they are targeting older people, and I can see some people falling for it. My dad is pretty sharp, and it still tricked him at first.

Other Scams to Look Out For

Other types of extortion scams involve the perpetrator posing as the IRS or a crime cartel framing you for a false crime that will result in a suspension of your bank accounts, criminal charges, or a threat to you or your family’s safety if you do not send money. For instance, there have been reports of victims on vacation receiving a call in their hotel room stating that they are being targeted by a drug cartel and should turn off their phones to remain safe. While the victim is out of communication, the virtual kidnappers demand money from friends and family.

To avoid this kind of virus:

- learn how to identify typical phishing strategies,

- do not click on unknown email links or websites,

- install premium security software, and

- keep your software updated.

- It is also important to backup computer data on a secure cloud-based backup service with revision history. Even legitimate websites can be hacked to spread malware, so awareness and preparation are key.

Here are GetKidsInternetSafe tips to avoid being a victim of virtual kidnapping:

- Stay up to date about the scams popular in your area.

- Set your social media profiles to private and avoid giving out personal information. Teach your kids to do the same with GetKidsInternetSafe techniques.

- Occasionally cleanse your social media profile of photos. A backlog of photos tells a detailed blueprint of your family’s activities and personalities. When viewed by a perpetrator, those details can be used against you.

- Keep your telephone landline.

- Download GPS location-sharing apps to family member phones, such as Find My iPhone, Find Friends, or Life360.

- Create an emergency plan, which includes a list sharing of names and phone numbers of workplace landlines, friends, and extended family. Create and include family nicknames to use in case of a need for emergency telephone identification.

- If you get a suspicious call, assess its authenticity. For example, if the call is not from the victim’s telephone and they want you to stay on the phone until the money is delivered, be suspect.

- If they are on the victim’s phone, recognize that the phone may have been hacked and forwarded to another phone or lost or stolen. Just because the number shows up as your child’s phone doesn’t necessarily mean the scammer has possession of the phone or the phone’s owner.

- Recognize that scammers often ask for money to be wired through services like Western Union or online currency like Bitcoin, as these methods of payment are untraceable.

- Stay calm, slow the caller down, and do not share any personal information. Ask them to answer a question only the victim would know. Don’t challenge or argue with the caller. Buy time by saying you are writing down the demand and need time to comply.

- Use another device to call the police while on the phone.

- Ask questions and, if feasible, demand a call from the victim’s phone or a picture of the victim.

- Get to a safe place as soon as possible.

These tips do not constitute legal advice from GetKidsInternetSafe. Although many of these suggestions are offered by the Federal Bureau of Investigation website, recognize that nothing outweighs your instincts. Err on the side of caution and seek expert help from your local police department or the FBI.

Worried about child identity theft? Check out this GKIS article to learn how to protect your child’s financial security. To learn about other scams effecting the elderly, read Scammers Target the Elderly: How to Avoid Being Scammed.

I’m the mom psychologist who will help you GetYourKidsInternetSafe.

Onward to More Awesome Parenting,

Tracy S. Bennett, Ph.D.

Mom, Clinical Psychologist, CSUCI Adjunct Faculty

GetKidsInternetSafe.com